Background

Certain charges, like sales tax, are calculated as a percentage of another charge. While amounts for sales tax could be input manually, you'll need to enter different amounts for every unique charge. With manual entry, the risk of input errors increases. Fortunately, Yardi has a built-in mechanism for handling this situation.

Process Overview

Configuring Yardi Breeze to calculate sales tax automatically is a multi-step process consisting of:

- Setting up sales tax with the appropriate rate,

- Associating certain properties to the sales tax record, and

- Configuring a charge code with sales tax enabled for a given revenue account.

With the above steps properly executed, the effect on the books we're looking for can be summarized by the journal entries that follow. Consider a scenario with $100.00 of rent with applicable sales tax of 2.0%.

Accrue rent revenue (time t).

| Accounts Receivable | 100 | |

| Rent Revenue | 100 |

Accrue sales tax (time t).

| Accounts Receivable | 2 | |

| Sales Tax Payable | 2 |

Notice the impact of sales tax occurs entirely on the balance sheet. The "Rent Revenue" is the only activity to hit the income statement. If the "sales tax" being paid is an obligation between the tenant and landlord instead of the tenant and taxing authority (like in Arizona with TPT), this may not be desirable.

See my article Accounting Differences Between Arizona Rent Tax and Sales Tax on the differences and considerations.

Otherwise, let's get started setting up Yardi Breeze for sales tax.

Set Up Sales Tax For Properties

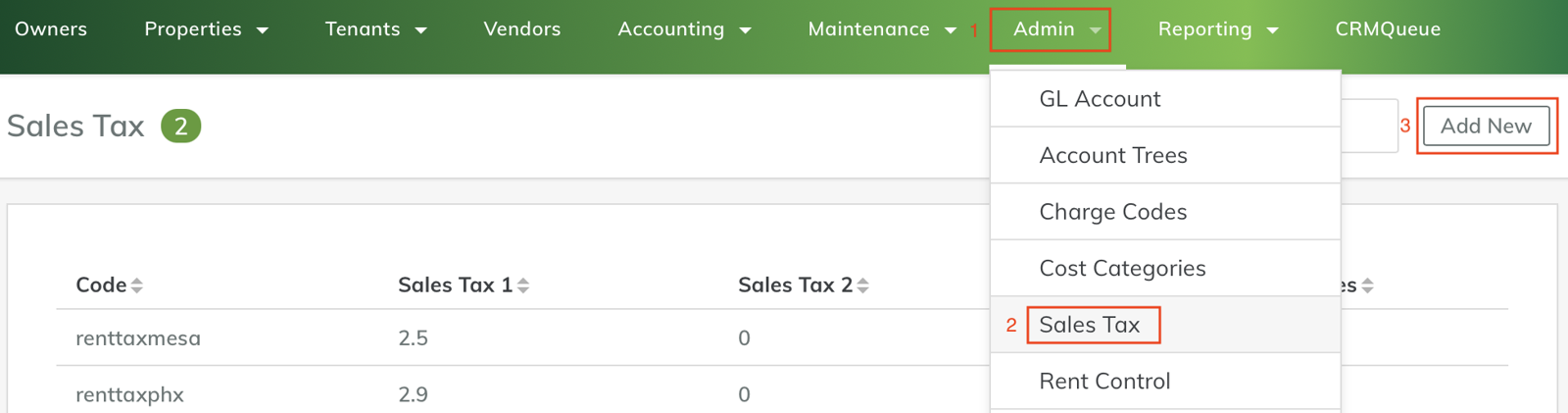

The first step (assuming properties, tenants, etc., already exist in the system) is to set up sales tax. This workflow can be accessed with Admin > Sales Tax > Add New.

Next, we'll set up sales tax for a given locale. For purposes of this example, we'll continue with 2.0%. This is a fictitious number used for presentation purposes.

With this view, we need to enter a code, select a state and optionally a city, and enter the appropriate rate.

For the "Code," I used a generic label that's unique to the locale. In this case, I chose "salestaxla" for "sales tax Los Angeles." Next, I select the state and city "CA" and "Los Angeles" respectively. The "State" field choices are populated from the states your properties are located in. The "City" field does the same but filtered on the "State" field value to include only those cities where you have properties for a given state.

Next, enter the rate in the "Sales Tax 1" field. The rate is represented as a percentage so 2% is 2.0, not 0.02.

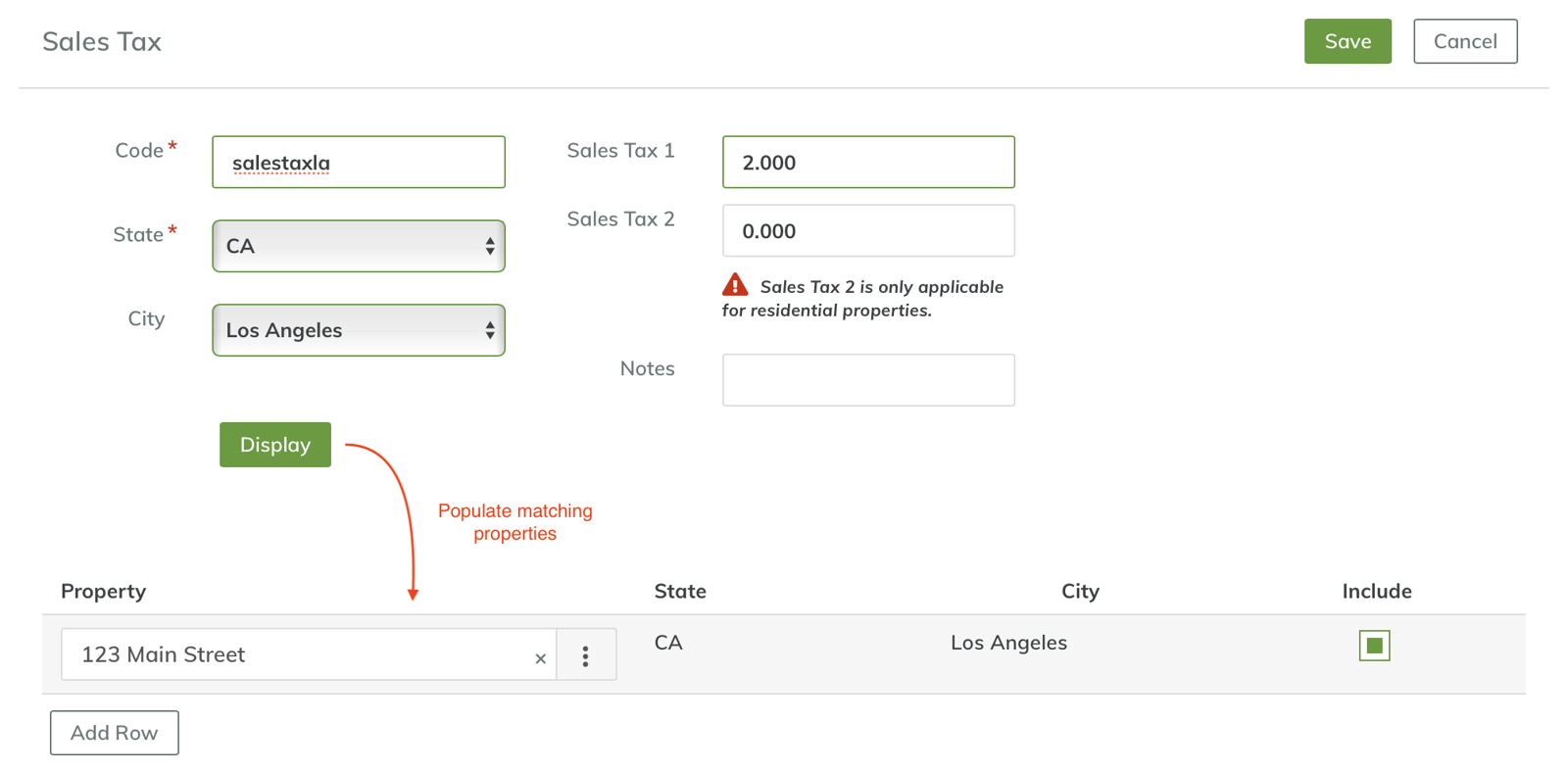

Last, we'll attach certain properties to the sales tax record. By clicking the "Display" button, properties that match the "State" and "City" fields will be automatically populated.

Sales tax records created without associated properties either fail to save or fail to appear in your sales tax records. I'm not sure if that's a bug or a feature but it's unexpected and confusing behavior. To be on the safe side, I recommend adding at least one property to the sales tax record at this stage.

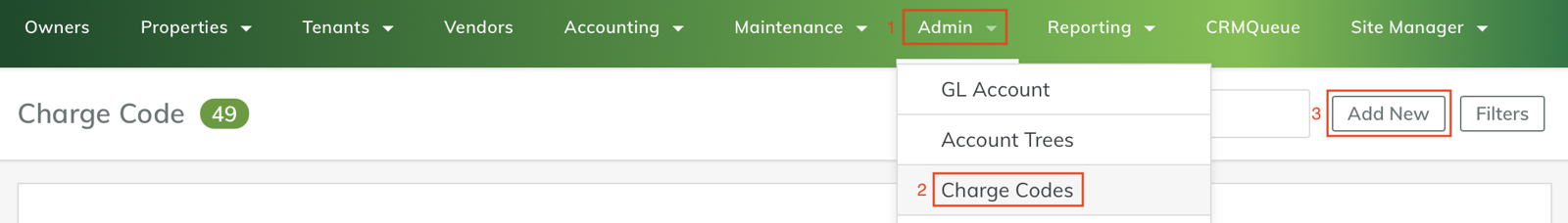

Configure Charge Code

Revenues in Yardi Breeze begin as "charges." This layer of abstraction allows for items like "sales tax" we're working on here to be created dynamically rather than from manual entry. Let's navigate to the "Charge Codes" section and create a new one: Admin > Charge Codes > Add New.

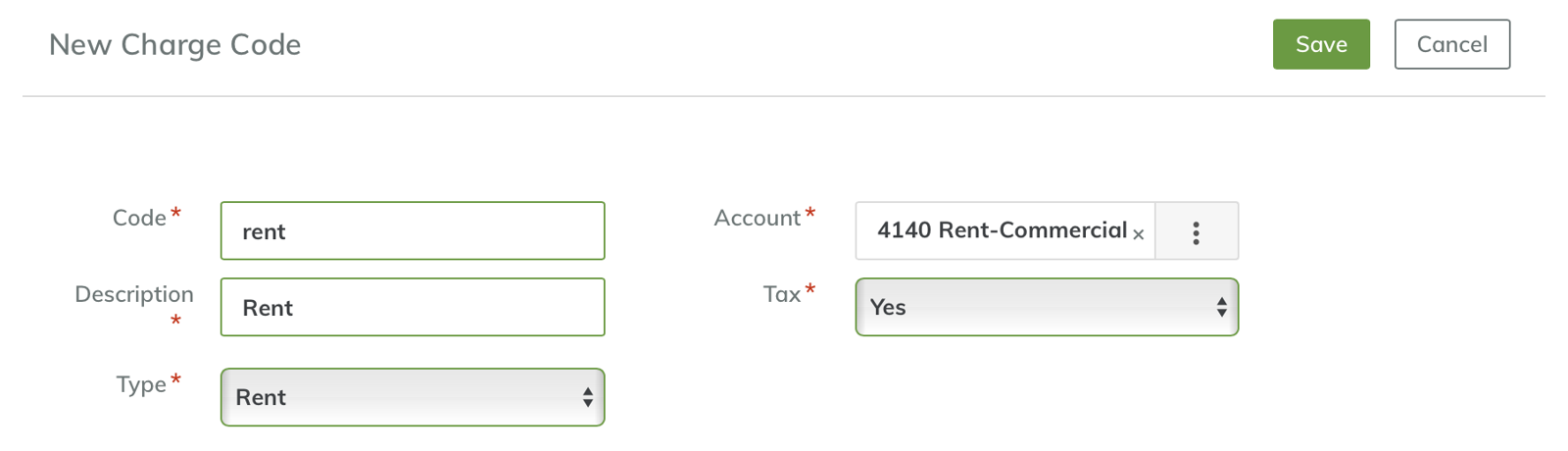

Now, let's add a new charge code.

To create a new charge code, we'll provide a label and description, differentiate a type (rent, cam etc.), connect a financial account and select if tax should be applied.

For the "Code" and "Description" fields, I'm using the generic labels "rent" and "Rent." When creating charges down the road, the "Description" field is what will be visible to you so make sure this value communicates the necessary information for you to make a proper choice.

For "Type" and "Account," I select the "Rent" choice and my commercial rent financial account ("Rent - Commercial") respectively. If you're establishing charges for items other than basic rental, update these fields appropriately.

Last and most importantly, we need to indicate that tax should be applied to our charge code by selecting "Yes" for the "Tax" field and click "Save." Note, we're not directly connecting the sales tax record created in the previous step to the charge code. This is because the charge code isn't location specific whereas sales tax is.

While I could use the charge code for any property in my portfolio where appropriate, sales tax is specific to a locale. To accommodate this, the system will query sales tax records associated with a particular property and calculate sales tax for a charge if the charge code is marked taxable.

With that out of the way, we're all set to start accruing taxable charges.

Demonstration

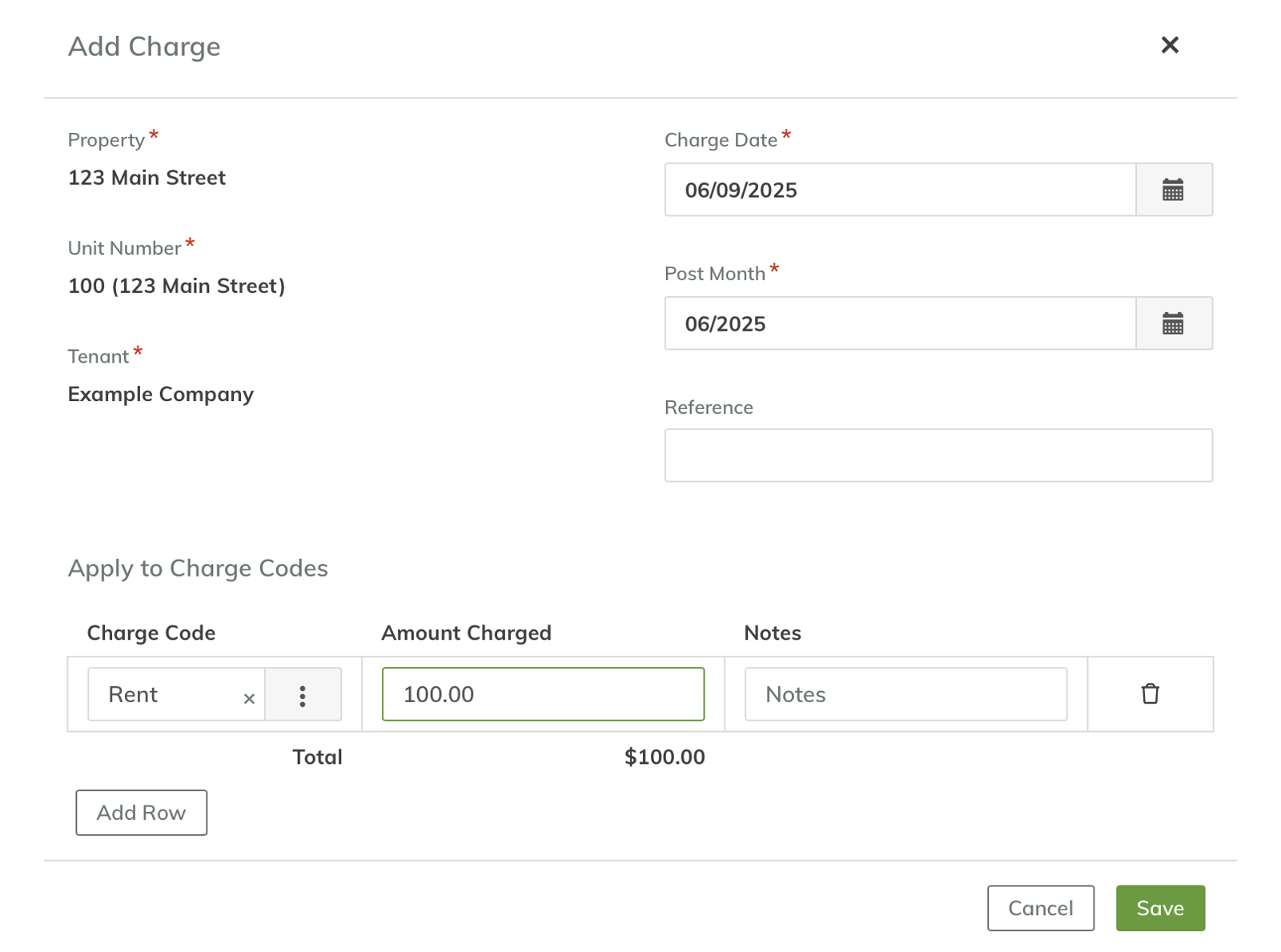

Let's see how all this comes together by creating a charge. I'll create a new charge from the tenant information page. The amount of the charge will be for $100 to remain consistent with our running example.

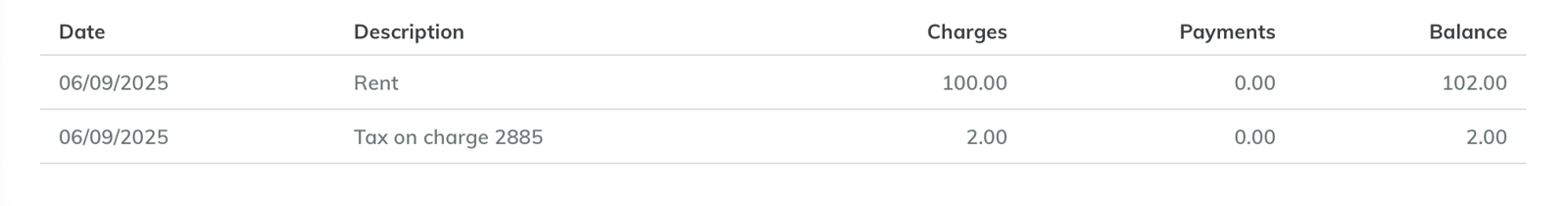

Now, let's inspect the tenant ledger to make sure records were created as expected.

From the above illustration, you can see that an accrual for $2.00 of sales tax was created for my $100 rent charge. Tax is now being applied automatically.

Final Thoughts

Using the built-in system for handling sales tax will make your workflow a bit easier for taxable rent charges. Avoiding manual entry will decrease errors and speed up the accounting process. If you haven't already, follow the steps here to get up and running quickly with automatic sales tax in Yardi Breeze.