Background

I'm unsure if my recent experiences with CHECKscan not processing correctly have anything to do with a recent software update, but I haven't had this problem before. Now I'm experiencing the issue often. Checks processed with CHECKscan are being rejected.

After reaching out to support, their best guess was that there was an image quality issue or the wrong "document type" was selected. Nothing has changed in my workflow, device used, or even lighting so I'm not sure what's causing the issue. Either way, it needs to be dealt with so our tenant ledgers are up to date and our cash accounts reconcile.

When tenant rent checks processed using the Yardi Breeze CHECKscan app aren't deposited correctly, you'll receive a notification that will redirect you to your payments dashboard. Alternatively, you can access the dashboard directly with Reporting > Electronic Payments > Payments Failures. From your payments dashboard window, you'll see the following displayed:

Clicking through the first item will display the checks that failed to process in a table below. From this table, we can inspect what receipts and deposits were affected.

Remedy Overview

Customer service recommends that checks not processed successfully be deposited normally through your bank. Fair enough, I'll use my banking app to deposit these items separately and enter a new receipt and deposit.

The problem remains, however, with what to do about our old deposit. Yardi doesn't adjust your deposits or receipts for payment failures so your tenant ledger, deposits, accounts receivable (potentially prepaids), cash accounts, and reconciliations will all be affected and overstated.

Here's how I approached the fix:

- Delete the original deposit;

- Reverse the affected receipt; and

- Create new deposit adjusted for the failed payment

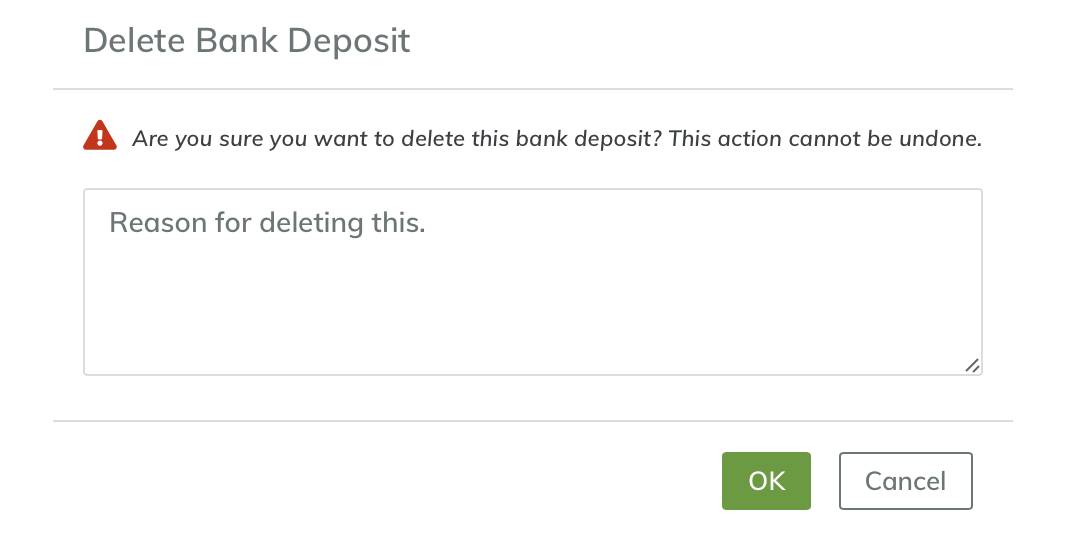

Delete Original Deposit

Beginning from the payments dashboard, select one of the failed payment items and you'll be redirected to that item's receipt. From the receipt window, you'll see at the top the related deposit created when you recorded the receipt.

![]()

Select the "Deposited" badge and you'll be redirected to the deposit record.

Place the deposit into the "edit" state by selecting the "pencil" icon in the upper-right corner of the window.

![]()

Now select "Delete" and provide a note to document the action.

![]()

With the deposit out of the way, we can move on to the receipt.

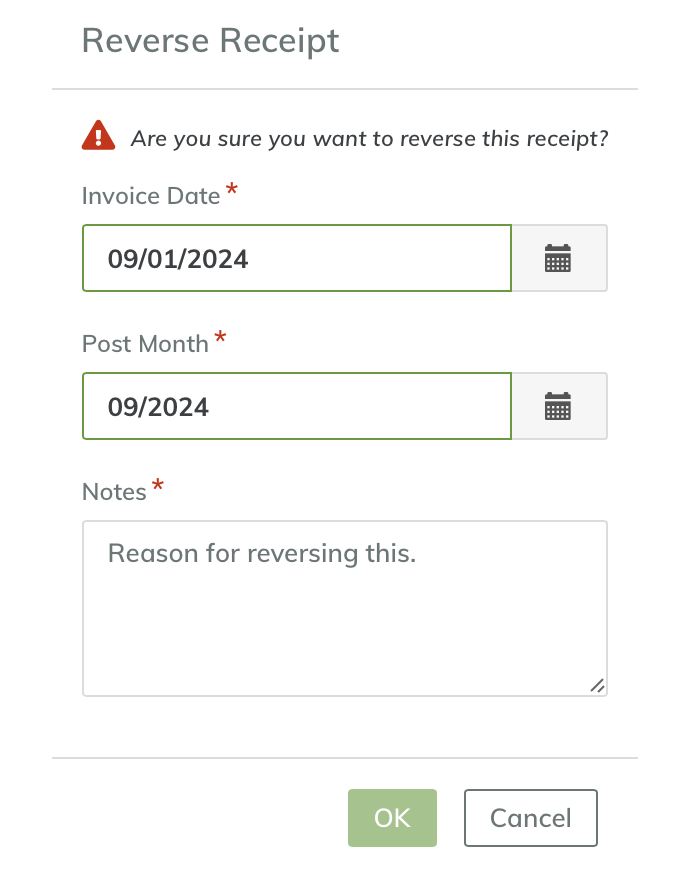

Reverse Receipt

Following the deposit deletion, you should be redirected to the related receipt. From the receipt window, I'm going to select the "pencil" icon to place the receipt into an "edit state."

![]()

Now select "Reverse."

![]()

And provide a detailed message.

As of this writing (8/15/24), Yardi Breeze seems to be having issues with deleting reversals. I deleted through the admin toolbox a receipt reversal. However, the reversal still remained attached to the original receipt causing the receipt to remain in 'read-only' mode and preventing a new reversal or any edits to the receipt.

Seems like a "soft-delete" software issue. To fix this, customer service had to manually delete the receipt and reversal and the process took a couple weeks. All the while my ledger wasn't accurate and my cash wouldn't reconcile. DO NOT DELETE THE REVERSAL.

The message you provide will be visible in the tenant's ledger and visible to the tenant. I'm using the more cryptic "Failed CHECKscan run.," borrowing Yardi's system notification language so it's clear to the tenant that what occurred wasn't due to any action on their side. In my experience, tenants can be very sensitive to how payment information is portrayed on their ledger and especially if the information may lead them to believe their payment bounced and a late charge may occur.

Also note the "Invoice Date" field (I'm guessing they meant "Receipt Date" and are simply reusing the dialogue box from the payables reversal window). I'm using the date of the original receipt here as well as the same "Post Month." When I re-enter the new receipt, I want to use this date a third-time. That way, The tenant will see on their ledger that the failed receipt, the reversal, and the correcting receipt all occur on the same date so they still receive credit for the timeliness (or lack thereof), of their payment.

Remember, the receipt date doesn't affect your cash reconciliation. The deposit that follows is what reconciles to cash.

With that, our receipt is reversed and we're now ready to create the new deposit that accounts for the reversed receipt.

Create Deposit With Failed Payment

Following the reversal, we should remain on the same receipt's page but the reversal will now be reflected. We click the 'Not Deposited' badge to start the process of creating an updated deposit.

![]()

From the "New Bank Deposit" window, we'll create the new deposit making sure to enter the correct date the deposit occurred. Select "Link Receipts to Bank Deposit" check boxes for each receipt in the original deposit. You'll additionally include the reversal receipt to cancel out the original failed payment. The sum of the selected receipts should be your original deposit less the bad payment. Last, set the "Deposit Date" to the date of the original deposit so that dates match on the bank reconciliation.

Select "Save" and your deposit will be created and ready for reconciliation. Mission accomplished.

Final Thoughts

This article demonstrates how to handle failed mobile check deposits using the Yardi Breeze CHECKscan app. Use caution when entering the note for the receipt reversal because this note is visible to the tenant. And most importantly, don't delete your reversal if you decide a change is needed due to a bug in their system. Leave the original receipt and reversal in the system until customer service is able to remove it on their side or you'll likely screw up your books like I did.